Grow your Character AI business with our payment services!

Deploy a global payment collection system on your website.

Your billing operations passport for innovative companies : smooth, 100% secure payments, even where others fail you. For all Businesses.

We'll take care billing operations. Focus on your product.

We integrate a global, secure payment collection system into your website. Compliance & taxes are a pain. Leave it to us, we’re approved to take care of it. All over the world.

Pay Out 24h!

Get paid in just 24 hours and keep your cash flow smooth without any delays

Starting Fees at 1%

Enjoy full access to your revenue without any rolling reserves holding you back

Support 24/7

Whenever you need it, with round-the-clock support available 24/7

Integration Flexibility

Seamlessly integrate with your existing tools and workflows, no matter how unique your setup

FREE UP YOUR MENTAL WORKLOAD

They trust us

An all-in-one platform to help you collect payments

Boost your business with our all-in-one platform, designed to simplify the management of your digital activities.

Automate payments, manage subscriptions, ensure global tax compliance, and protect yourself from fraud effortlessly.

Take advantage of intuitive tools to drive your growth, recover failed payments, and support multiple currencies.

With our solution, everything becomes easier: focus on what really matters, we’ll take care of the rest.

Instant Startup

As soon as you integrate our solution, you can start quickly without going through complex setups. In just a few clicks, you're ready to sell your products on a global scale.

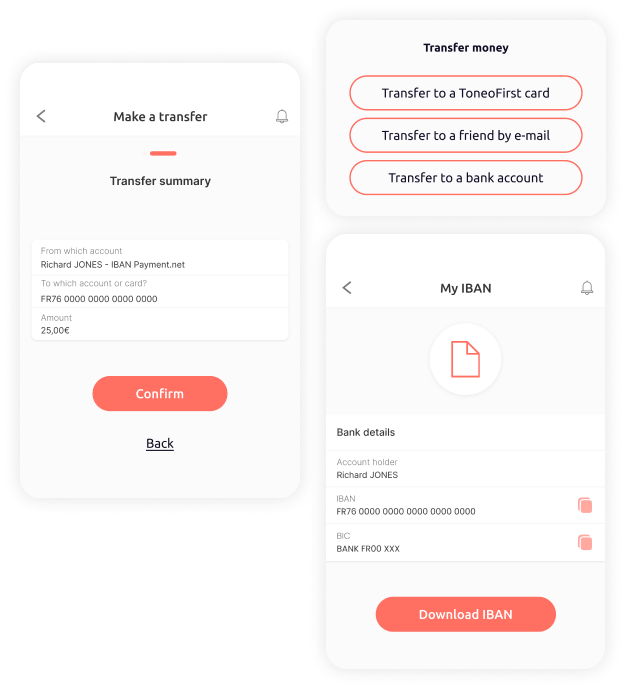

Complete Payment Management

We handle everything related to payments for you: credit cards, PayPal, bank transfers, and even multiple currencies. You only have one provider to manage for streamlined global billing.

Global Tax Compliance

Don’t worry about tax management anymore. Our system handles tax obligations in every region around the world, ensuring automatic compliance without extra effort on your part.

Churn Reduction and Failed Payment Recovery

With our advanced tools, we automatically recover failed payments and reduce your customers’ churn rate, helping you improve retention and stabilize revenue.

Detailed Analytics and Insights

Access real-time reports on your business performance with key indicators like conversion rate, monthly recurring revenue (MRR), and more. Optimize your strategy and identify growth opportunities with precision.

Instant Startup

As soon as you integrate our solution, you can start quickly without going through complex setups. In just a few clicks, you're ready to sell your products on a global scale.

Complete Payment Management

We handle everything related to payments for you: credit cards, PayPal, bank transfers, and even multiple currencies. You only have one provider to manage for streamlined global billing.

Global Tax Compliance

Don’t worry about tax management anymore. Our system handles tax obligations in every region around the world, ensuring automatic compliance without extra effort on your part.

Churn Reduction and Failed Payment Recovery

With our advanced tools, we automatically recover failed payments and reduce your customers’ churn rate, helping you improve retention and stabilize revenue.

Detailed Analytics and Insights

Access real-time reports on your business performance with key indicators like conversion rate, monthly recurring revenue (MRR), and more. Optimize your strategy and identify growth opportunities with precision.

Collect payments in 150+ currencies

Enables your business to collect payments from any customer in the world

Built to protect your Business

Fraud is not a fatality : artificial intelligence and evolutive solution can help you maximize your profit by lowering the fraud risk

Beat Fraud Now !

We maximize the protection your business by enabling 3 layers of anti-fraud systems. Anti-filters can be adapted to match perfectly your business and avoid conversion rate decrease... We understand the context of fraud risk for each payment solution that we provide.

Fight Chargebacks

We help you to dispute chargeback and get the money back. In the digital services industry -the most complex industry in term of chargeback as the proof of delivery is virtual- we have a dispute case win rate of 63,54%.

Safety and Compliance

We take security seriously. Our system complies with the strictest industry standards to ensure your customers’ data is protected

✅ PCI DSS Compliant

✅ RGPD

✅ Risk monitoring

✅ Dedicated Account Manager

✅ Customized strategy

Pricing

Euro Zone 🇪🇺

Suitable for businesses operating in Europe, with payment needs exclusively in EUR.-

Processing of European cards (Visa, Mastercard, etc.)

-

Advanced fraud protection with integrated machine learning

-

Easy API integration for quick deployment

-

Refund and dispute management via the Payment.net dashboard

-

Access to real-time analytical reports to monitor your financial flows

International 🌍

Ideal for businesses operating in multiple international markets and needing multi-currency payment options.-

Support for international payments

-

Multi-currency: Acceptance of payments in USD, GBP, JPY, and other currencies

-

International API and SDK for seamless integration across all markets

-

Automatic currency conversion to simplify payments

-

Multilingual support for a smooth user experience worldwide

All Inclusive Plan 🚀

Custom solution for large businesses requiring comprehensive payment management, from technical infrastructure to dedicated support.-

Global payment management for large accounts

-

Advanced customization of fees based on your industry and transaction volumes

-

Priority 24/7 support with a dedicated account manager

-

International tax optimization and regulatory compliance (PSD2, GDPR)

-

All-in-one solution covering your company’s technical, legal, and financial needs

The most frequently asked questions

What is Payment.net, and how does our online payment solution work?

Payment.net is an online payment service provider (PSP) that simplifies financial flow management for online businesses. Our solution allows professionals to process payments, accept various payment methods, and secure transactions. It easily integrates with your website, enabling straightforward management of financial flows.

How does Payment.net ensure transaction security?

We adhere to the strictest security standards, including data encryption and PCI-DSS (Payment Card Industry Data Security Standard) compliance. Our systems automatically detect and block suspicious activities to protect transactions and your customers’ data.

What are the settlement timelines and fund withdrawal options with Payment.net?

At Payment.net, we understand the importance of quickly accessing funds for cash flow management. Our settlement timelines are customizable based on your needs, offering daily, weekly, or monthly disbursement options. We also adapt withdrawal terms according to your industry, payment volume, and business size. Our solutions allow maximum flexibility, making funds available according to your preferences and financial requirements.

Which payment methods are supported by Payment.net?

Payment.net accepts major credit cards, digital wallets (Apple Pay, Google Pay), and bank transfers. This flexibility accommodates customers’ preferences, helping you maximize conversions.

What are the service fees for Payment.net?

Our fees depend on transaction volume and each client’s specific needs. We offer transparent, no-hidden-fee pricing tailored to both small businesses and large accounts. For a personalized quote, feel free to contact our team.

How do I integrate Payment.net with my website?

Our solution integrates easily via APIs, plugins for popular e-commerce platforms (WooCommerce, Shopify, etc.), and detailed documentation. We also provide dedicated technical support to assist at every step of the integration process.

Does Payment.net support subscription management and recurring payments?

Yes, we offer recurring payment functionality for businesses that manage subscriptions. You can easily set up, automate, and track recurring payments to optimize cash flow management.

How can I access payment information and reports?

From your Payment.net dashboard, you can access real-time transactions, generate detailed reports, and gain insights into sales performance. Our analytics tools help you understand your payment flows better and make informed decisions.

How does Payment.net handle refunds and disputes?

You can easily manage refunds directly from the dashboard, with options for full or partial refunds. In the event of a dispute, our team assists you in quickly resolving issues with your customers.

Is Payment.net compliant with international regulations?

Yes, we comply with international payment regulations, including the PSD2 directive in Europe and data protection standards such as GDPR. Our solution also supports multi-currency management to facilitate international transactions.

How do I contact Payment.net customer support?

Our customer support team is available 24/7 via email to answer your questions and assist you with using our payment solution. We are committed to providing fast, professional support.